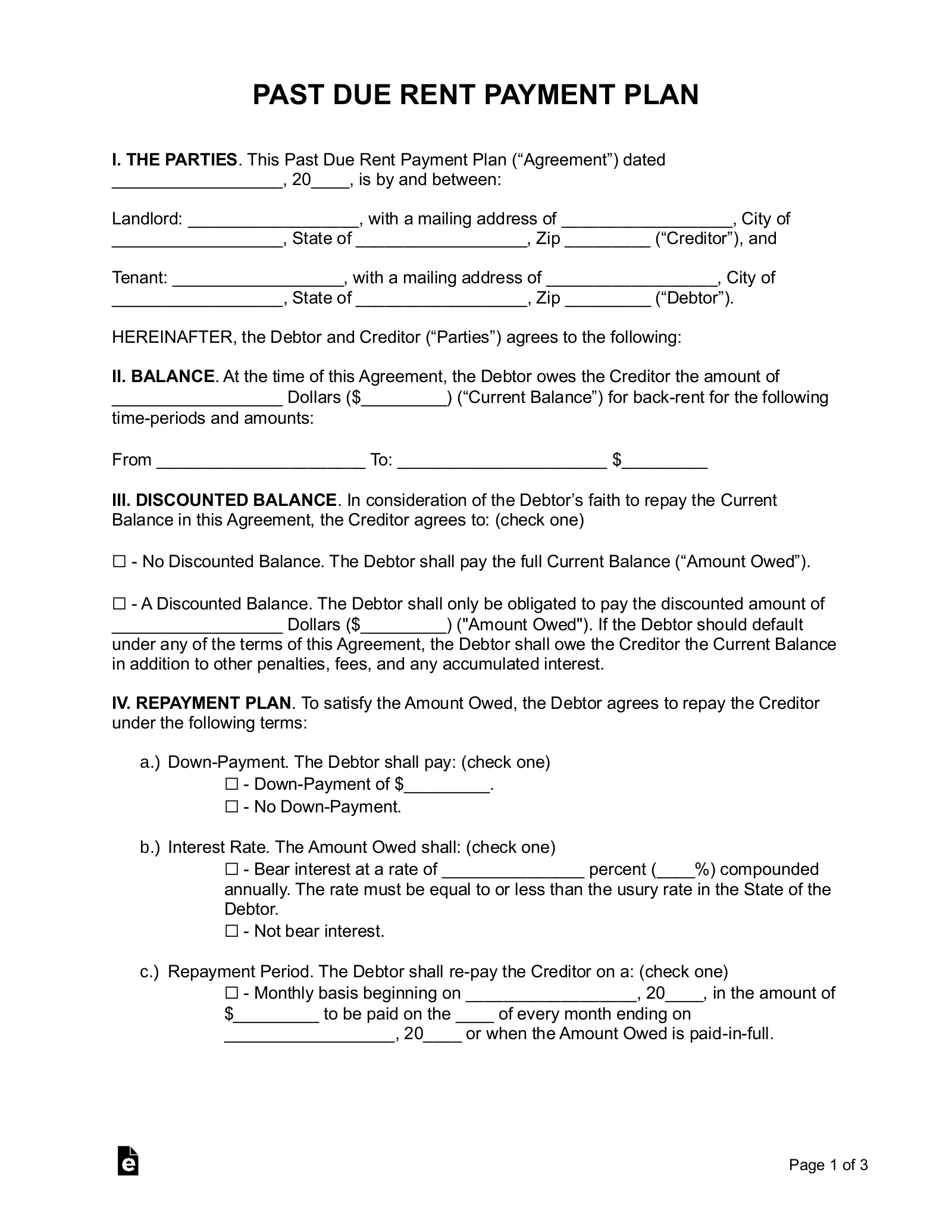

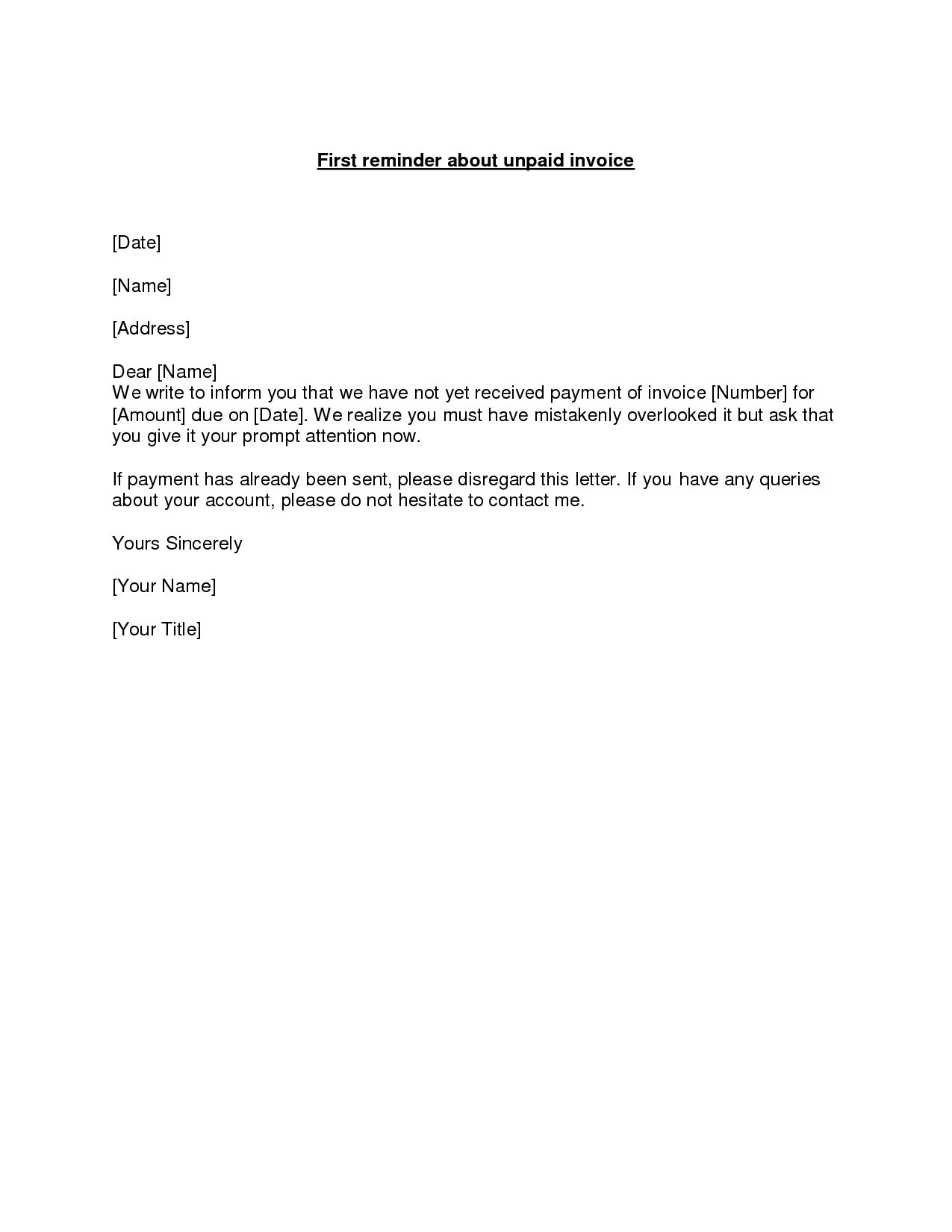

Finding the gray area between assertive and friendly is always difficult. While your tone needs to become more assertive since the first letter seems to have gone ignored, you still need to remain friendly towards to customer. The second collection letter can be a tough balancing act. Thank you for your prompt response to this request and for your continued business. If there is some error or you are unable to pay at this time, please contact me at so we can correct any errors or arrange for another payment plan. Please contact us or send your payment of $ to the address below by Apif you have not already done so. We would much appreciate if you could let us know the status of this payment. In the event you have not received these messages and documents, we have provided a summary of your account below. We have emailed a detailed copy of your account statements. According to our records your balance of $ is currently. This is just a friendly reminder that your account is past due. The First Collection Letter Template to Customer Due date for payment- it is important to use an actually date, not “in the next 7 business days” as this can be vague.Instructions- what would you like them to do next?.This first collection letter should contain the following information: By giving them a chance for explanation before getting upset and pushy, you are able to keep a great customer-vendor relationship. There are many reasons why the customer has not paid on time, such as never receiving the invoice or missing something important on the invoice. Since this is only the first letter, it is important to keep the tone friendly, informative and professional. The first collection letter should be sent out to the non-paying customer as soon as the invoice has gone past due. By now you have sent the invoice, sent due date reminders and let them know when the invoice has gone past due.

Make sure you always make on-time payments and follow our tips for preventing late payments below.Just because this is the first collection letter, this doesn’t mean this is your first point on contact with the customer. Missing one payment might not be terrible, but if you make a habit of paying late, it can have serious implications. If your card doesn't have these perks, simply pick up the phone or live chat with customer service and ask if the fee can be waived. There are even some cards that automatically waive your first late payment, such as the Discover it® Cash Back, or have no late payment fees at all, like the Citi Simplicity® Card. If this is your first late payment, chances are good that your card issuer may waive the late fee. And if it's more than 30 days past due, you can still minimize the damage by paying at least the minimum as soon as you can.Ĭall your card issuer and try to negotiate your payment If your payment is less than 30 days past due, you can avoid it hitting your credit report. The sooner you make a payment, the better. Pay at least the minimum as soon as possible Here's what you should do to minimize the negative effects of a late payment: If you missed a payment, it's important to take action fast.

Past due payment free#

Investing +More All Investing Best IRA Accounts Best Roth IRA Accounts Best Investing Apps Best Free Stock Trading Platforms Best Robo-Advisors Index Funds Mutual Funds ETFs Bonds

Past due payment how to#

Help for Low Credit Scores +More All Help for Low Credit Scores Best Credit Cards for Bad Credit Best Personal Loans for Bad Credit Best Debt Consolidation Loans for Bad Credit Personal Loans if You Don't Have Credit Best Credit Cards for Building Credit Personal Loans for 580 Credit Score Lower Personal Loans for 670 Credit Score or Lower Best Mortgages for Bad Credit Best Hardship Loans How to Boost Your Credit Score

Past due payment software#

Taxes +More All Taxes Best Tax Software Best Tax Software for Small Businesses Tax Refunds

Small Business +More All Small Business Best Small Business Savings Accounts Best Small Business Checking Accounts Best Credit Cards for Small Business Best Small Business Loans Best Tax Software for Small Business Personal Finance +More All Personal Finance Best Budgeting Apps Best Expense Tracker Apps Best Money Transfer Apps Best Resale Apps and Sites Buy Now Pay Later (BNPL) Apps Best Debt Relief

0 kommentar(er)

0 kommentar(er)